Testing the potential of cryptocurrencies can come in numerous application formats, including industries like healthcare and gaming and operational modes like trading or storing assets. With new digital tokens released on a monthly basis, it is unreasonable to miss your market entry ticket to excellent services and opportunities. The list includes data security, minimized risks of fraud, reduced transaction fees, no downtime, and much more. You can enjoy all those benefits in an all-inclusive manner thanks to crypto exchange platforms.

There are several features you expect to see while using a modern crypto exchange — from accurate cryptocurrency rates trackable in real-time mode to an advanced notification system to keep up with the latest changes in the market. If you don’t want to miss valuable digital assets, it is essential to take your time before joining any crypto buy-and-sell community. Keep reading this article to get a better understanding of what your decision-making strategy should be like. Onwards!

Conduct Research

Checking reviews and ensuring the licensed and credible performance of the company are must-have stages of your search for the right crypto exchange. At the same, diving deeper into its performance specifications won’t be extra. For example, don’t forget to identify the target system’s type — centralized or decentralized:

- CEX is a digital venue operated and governed by a so-called exchange operator. They are quite similar to the nature of the stock market, coming with transaction fees and other special user terms and conditions.

- In turn, DEX is a blockchain-based format, coming without central supervision. Although it requires a higher degree of tech-savviness from interested parties, it is typically more beneficial in terms of its management and trading options’ divergence.

The Number of Exchangeable Coins and Tokens

Choosing the platform with the biggest number of crypto assets available is a popular strategy. Still, it lacks personalization and doesn’t show how much authority you actually get within the target system. Quantity doesn’t necessarily equal quality. So your task is to ensure the platform offers already successful projects like Bitcoin and can release new coins at more favorable prices.

Final Thoughts

When investing in any type of crypto asset, selecting the best exchange system is of vital importance. Not only will you maintain the health and quality of your portfolio, but you will also protect your funds from several risks and problems like fraud. By staying cautious of what companies offer and doing your research, you will select networks with better security, functionality, and overall performance. Whether you decide on niche offers like BIT.TEAM or classic selections like Coinbase or Binance, you have to ensure their offers match your investment potential and strategy.

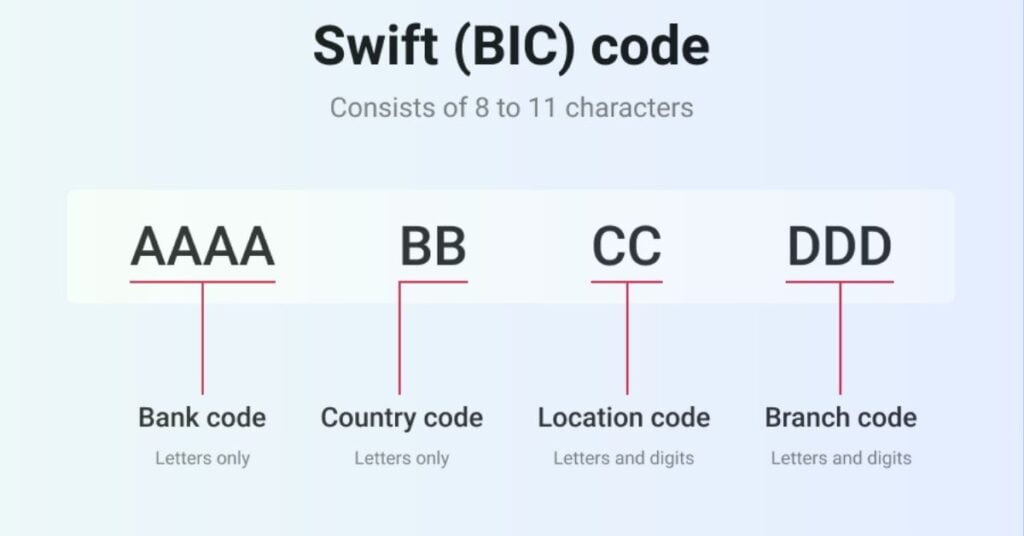

Check our previously published article on What is Bic Code?